Business Debt Recovery Estimator

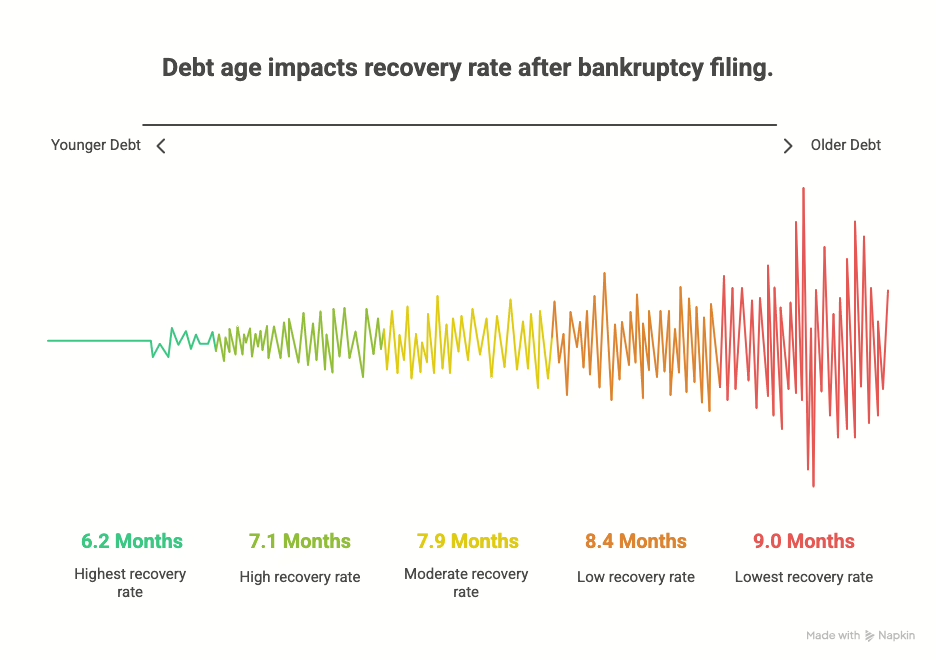

Wondering how much of your outstanding invoices you can actually recover? Use our Business Debt Recovery Estimator Tool to get a quick projection based on the age of your debt and your typical collection agency fee.

How It Works

As invoices age, the likelihood of successful recovery decreases. This tool helps you visualize that drop-off and gives you a realistic look at what your business could recover after standard collection fees.

- Enter the total amount owed

- Select the age of the debt – from due date to over 2 years past due

- Choose the collection agency fee (typically 15–25%)

- View the estimated net recovery and a visual breakdown

Why This Matters

Unpaid receivables can quietly drain your business. By understanding how timing and agency fees impact your bottom line, you can make more informed decisions about when to pursue third-party collection support.

If your estimated recovery is too low, we recommend you request a free quote to evaluate your options for those hard-to-collect accounts.

Try the Estimator Below

This tool is free to use and can be completed in just seconds.

Estimated Recovery: $0

You May Receive After Collection Fees: $0

As a finance manager, you understand the importance of a smooth and timely financial close. But even with the best strategies, challenges can arise. That’s where the right partnership can make all the difference. At Burt and Associates, we specialize in tailored, ethical debt collection practices that align with your business goals. By integrating our services, you can focus on optimizing your financial close process without the added stress of managing overdue accounts.

We know every business is unique, and that’s why we work closely with you to develop a customized approach that meets your specific needs. Whether you’re dealing with complex financial situations or simply looking to improve cash flow, our team is here to support you every step of the way.

Let’s turn those strategies into results together. Take the first step towards a more efficient financial close by reaching out to us today.

Let's Work Together to Optimize Your Business!

At Burt and Associates, we specialize in business-to-business (B2B) debt collection, prioritizing strong business relationships and tailored ethical recovery practices. Choose the approach that best fits your needs, and let’s take the first step toward improving your cash flow.

If you’re ready to discuss your overdue accounts and explore customized solutions, schedule a free consultation with one of our experts.

Schedule an Appointment.

Commercial Collection Topics

- Credit Letter When your company is involved in exporting, if the documents presented do not conform precisely to the terms of the...

- Commercial Business Loans Interest payments. When a lender establishes an interest rate, it must comply with any applicable state usury laws...

- 2024 FDCPA: Key Updates to the Fair Debt Collection Practices Act The Fair Debt Collection Practices Act (FDCPA) serves as a foundational piece of legislation protecting consumers from abusive debt...