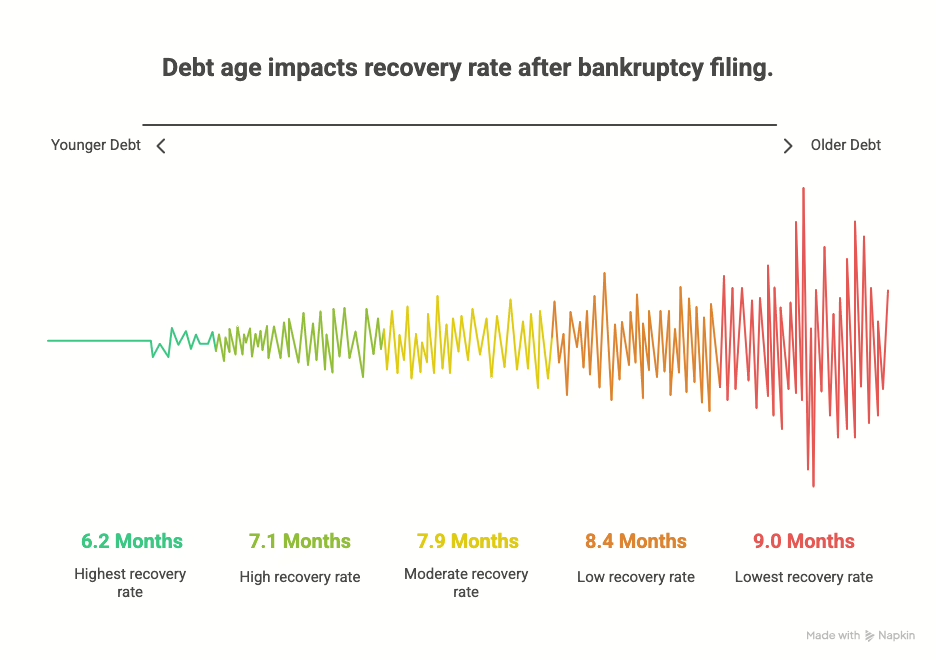

How Business Bankruptcies Impact Debt Collection

Discover how business bankruptcies impact commercial debt collection and what steps creditors can take to minimize losses. Learn key preventive strategies and explore real bankruptcy trends in this detailed guide by Burt and Associates.

Read article