The Fair Debt Collection Practices Act (FDCPA) is a cornerstone of consumer protection laws in the United States. It ensures that debt collectors adhere to specific ethical and legal standards when pursuing debts. Since its inception in 1977 and through several amendments (most notably Public Law 111-203 in 2010), the FDCPA has played a pivotal role in safeguarding consumer rights while also clarifying debt collectors’ obligations.

The Fair Debt Collection Practices Act (FDCPA) is a cornerstone of consumer protection laws in the United States. It ensures that debt collectors adhere to specific ethical and legal standards when pursuing debts. Since its inception in 1977 and through several amendments (most notably Public Law 111-203 in 2010), the FDCPA has played a pivotal role in safeguarding consumer rights while also clarifying debt collectors’ obligations.

Here are a few essential takeaways from the FDCPA:

1. Protecting Consumer Privacy

The FDCPA places significant emphasis on protecting consumers’ privacy. Debt collectors are prohibited from communicating with third parties about a consumer’s debt with few exceptions. Additionally, all communications must be conducted in a manner that does not embarrass or harass the consumer.

2. Harassment and Abuse Restrictions

The law strictly forbids any conduct that could be considered harassment or abuse. This includes repeated phone calls intended to annoy, abuse, or harass someone about their debt. Abusive language, threats of violence, and obscene language are also prohibited.

3. Accurate Representation

Debt collectors must be truthful about the nature of the debt. Misrepresentations, such as inflating the amount owed or falsely claiming legal consequences, are clear violations of the FDCPA.

4. Validation of Debts

Under the FDCPA, consumers have the right to dispute their debt. Debt collectors must provide a validation notice within five days of their first communication, which details the amount of the debt, the creditor, and the steps the consumer can take if they wish to dispute it.

5. Legal Recourse for Violations

Consumers can take legal action if their rights under the FDCPA are violated. Civil liabilities may include damages for emotional distress and attorney fees and punitive damages in more severe cases.

2024 FDCPA Highlights.

§801. Short title

- The FDCPA, officially titled the Fair Debt Collection Practices Act, establishes the law regulating debt collection practices across the U.S.

§802. Congressional findings and declaration of purpose

- Congress found that abusive debt collection practices harm consumers, causing personal bankruptcies and other negative social impacts. The Act aims to curb these practices and protect consumers.

§803. Definitions

- Debt collector: Any person or agency whose primary business is collecting debts on behalf of others, including collection agencies, lawyers who regularly collect debts, and companies that buy debts for collection.

§804. Acquisition of location information.

- Debt collectors may communicate with third parties only to obtain a debtor‘s location information, but they cannot reveal the nature of their call or that the person owes a debt.

§805. Communication in connection with debt collection.

- Debt collectors cannot contact a debtor at inconvenient times (before 8 AM or after 9 PM) without consent or communicate with them at their place of employment if it is known that the employer prohibits such communications.

§806. Harassment or abuse.

- Debt collectors are prohibited from harassing, abusing, or oppressing any person in connection with collecting a debt, which includes making threats or using profane language.

§807. False or misleading representations.

- It is illegal for debt collectors to use false representations in order to collect a debt, such as pretending to be a government representative or lying about the amount owed.

§808. Unfair practices

- Debt collectors cannot engage in unfair practices such as collecting any amount (including interest or fees) not authorized by the original agreement or allowed by law.

§809. Validation of debts

- Within five days of the initial communication, the debt collector must provide a written notice of the debt, outlining the amount owed, the creditor’s identity, and the consumer’s rights to dispute it.

§810. Multiple debts

- When a consumer owes multiple debts, payments must be applied as the consumer directs and not towards debts that are disputed.

§811. Legal actions by debt collectors

- Debt collectors must bring legal actions only in the judicial district where the consumer resides or signed the contract.

§812. Furnishing certain deceptive forms

- It is unlawful to design forms that falsely imply involvement by a third party in debt collection, creating confusion about the true collector.

§813. Civil liability

- Debt collectors who violate the FDCPA can be held liable in civil court for damages, and the consumer may recover costs, including attorney’s fees.

§814. Administrative enforcement

- Federal Trade Commission (FTC) and other federal agencies are responsible for enforcing the FDCPA regulations.

§815. Reports to Congress by the Bureau; views of other Federal agencies

- The Bureau of Consumer Financial Protection is required to report to Congress on FDCPA compliance and enforcement annually.

§816. Relation to State laws

- State laws that provide greater consumer protection than the FDCPA are not preempted, meaning those stronger state laws will take precedence.

§817. Exemption for State regulation

- The Bureau can exempt certain state debt collection practices if the state laws offer substantial consumer protections that align with the FDCPA.

§818. Exception for certain bad check enforcement programs

- Private entities working with a state or district attorney in bad check enforcement programs are exempt from the definition of "debt collector."

§819. Effective date

- The FDCPA became effective six months after it was enacted, but certain provisions apply only to debts where collection efforts began after the effective date.

Now that you’re familiar with the key elements of the Fair Debt Collection Practices Act (FDCPA) and how it affects your business, it’s time to put that knowledge into action. Ensuring compliance with these regulations isn’t just about avoiding penalties—it’s about building trust and maintaining a positive reputation with your customers.

At Burt and Associates, we specialize in providing ethical and effective debt recovery services. Let us help you easily navigate these regulations, ensuring your collections process is both compliant and successful.

Ready to optimize your debt collection strategy? Contact us today!

Let's Work Together to Optimize Your Business!

At Burt and Associates, we specialize in business-to-business (B2B) debt collection, prioritizing strong business relationships and tailored ethical recovery practices. Choose the approach that best fits your needs, and let’s take the first step toward improving your cash flow.

If you’re ready to discuss your overdue accounts and explore customized solutions, schedule a free consultation with one of our experts.

Schedule an Appointment.

Commercial Collection Topics

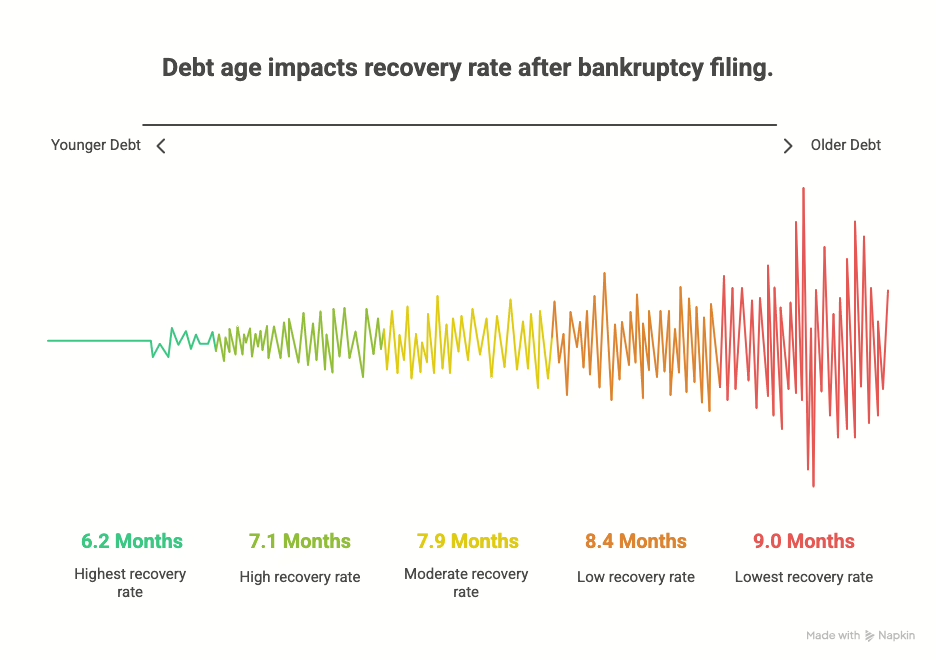

- Commercial Collections Recovery Rate of 39 % when the industry average 23 %, Achieve 33% Higher level of Collection vs Industry Average...

- Tax Debt Collection and You As a taxpayer, you can protect yourself from shady debt collecting practices by being aware of your debt situation. Private...

- Options and Accounts Receivable What an option is and how to settle (close) the transaction. Comment about using accounts receivables to buy an option....

- California Debt Collection Compliance Updates: A Guide for Businesses In this episode, we explore the latest developments in California debt collection compliance. With the Department of Financial Protection and...