At Burt and Associates, we understand that navigating the world of debt collection can be tricky. From ensuring proper documentation to handling sensitive legal matters, avoiding common mistakes is crucial to success. This guide is designed to help businesses stay on top of their debt collection efforts while avoiding costly errors.

1. Keep Detailed Records

One of the biggest mistakes in debt collection is not having the right paperwork. Always ensure a solid paper trail, including the original debt agreement, communication logs, payment history, and other documents. This helps you stay organized and is key if legal issues arise.

2. Stay Compliant with Regulations

Debt collection laws like the Fair Debt Collection Practices Act (FDCPA) are there to protect both you and the debtor. Ignoring these regulations can lead to lawsuits, fines, and damage to your business’s reputation. Always make sure your practices are fully compliant with the law.

3. Professional Communication is Key

Aggressive or unprofessional communication is a common pitfall. Treating debtors with respect can lead to smoother interactions and quicker resolutions. Stay professional, clear, and courteous in all your communication.

4. Verify the Debt Before You Collect

Before you begin the collection process, ensure the debt is valid and you’re contacting the right person. Overlooking this step can lead to wasted time and legal complications.

5. Accurate Credit Reporting

If you’re reporting debts to credit agencies, it’s crucial to get it right. Misreporting can lead to legal trouble and harm your professional image. Ensure the information is correct and updated once the debt is paid.

6. Protect Privacy

Never disclose debt information to third parties without permission. Violating a debtor’s privacy is illegal and can hurt your business’s reputation. Always be cautious when leaving messages or discussing sensitive information.

7. Be Reasonable with Repayment Plans

While recovering the full debt is important, demanding more than the debtor can reasonably pay can backfire. Work with them to create a realistic payment plan that suits both parties.

8. Don’t Ignore Debt Validation Requests

Debtors have the right to ask for validation of their debt. Make sure to respond promptly with the proper documentation to build trust and avoid any legal issues.

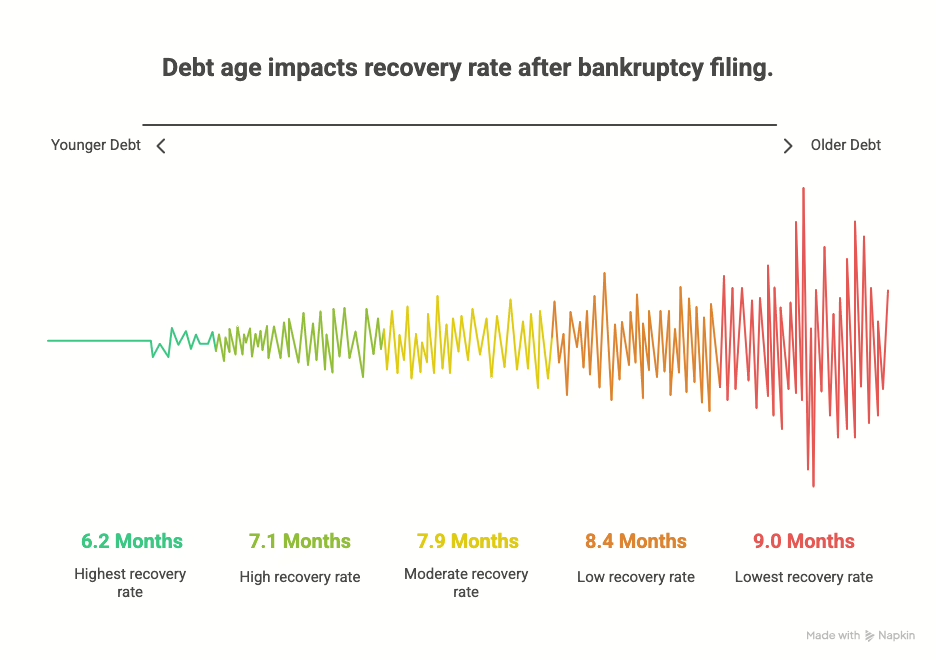

9. Know the Statute of Limitations

Every debt has an expiration date. Once a debt surpasses its statute of limitations, it’s no longer legally collectible. Knowing your state’s time limits for debt collection can save you from pursuing uncollectible debts.

10. Seek Legal Help When Needed

Some debt collection cases are complex. Don’t hesitate to consult legal experts when necessary. They can guide you through difficult situations and ensure your collection practices stay within the law.

By following these strategies, you can avoid the common pitfalls of debt collection and ensure a smoother, more successful recovery process. However, implementing them effectively can be challenging without the right support.

At Burt and Associates, we specialize in ethical debt collection practices tailored to your business needs. Whether you’re looking to streamline your debt recovery or navigate complex financial issues, our team is here to help you every step of the way.

Ready to optimize your financial health and cash flow? Let’s work together to create a customized solution that works for you.

Let's Work Together to Optimize Your Business!

At Burt and Associates, we specialize in business-to-business (B2B) debt collection, prioritizing strong business relationships and tailored ethical recovery practices. Choose the approach that best fits your needs, and let’s take the first step toward improving your cash flow.

If you’re ready to discuss your overdue accounts and explore customized solutions, schedule a free consultation with one of our experts.

Schedule an Appointment.

Commercial Collection Topics

- 2024 FDCPA: Key Updates to the Fair Debt Collection Practices Act The Fair Debt Collection Practices Act (FDCPA) serves as a foundational piece of legislation protecting consumers from abusive debt...

- The Role of Communication in Debt Recovery: Tips for Effective Conversations Effective communication is at the heart of successful debt recovery. Whether you’re speaking with clients, debtors, or internal stakeholders, how...

- Avoiding Bad Debts Part 1 Start by developing a written payment policy. One of the best actions you can take to help customers pay promptly...

- Avoiding Bad Debts Part 2 The Game of Thrones is, "A Lannister always pays their debts." Even the 'bad guys' in Game of Thrones...