Few corporate stories are as dramatic or as instructive as Kodak's. Once the unquestioned leader of the photography world, Kodak filed for Chapter 11 bankruptcy in 2012 after struggling to adapt to the digital revolution. Many believed the company's legacy was finished. Yet a decade later, Kodak film is not only back on shelves but in higher demand than anyone predicted. Their revival serves as a powerful reminder for business owners that bankruptcy is not the end of the road but often the start of a strategic reset.

Table of Contents

- Kodak’s Fall: How a Giant Lost Its Grip

- Bankruptcy as a Rebuilding Tool

- The Surprising Return of Kodak Film

- Lessons for B2B Companies and Creditors

- On a Final Note

Kodak’s Fall: How a Giant Lost Its Grip

For most of the 20th century, Kodak was synonymous with photography. They dominated film, cameras, and processing services. But when digital photography exploded, Kodak hesitated. The company actually invented one of the first digital cameras, but leadership feared it would threaten their profitable film division. By the time Kodak embraced the digital shift, competitors had already transformed the market.

The company faced declining revenue, shrinking market share, and overwhelming debt. Their film sales collapsed, and their once-iconic brand felt disconnected from modern consumers. The financial strain became impossible to ignore, leading Kodak to file for Chapter 11 bankruptcy protection in 2012.

Bankruptcy as a Rebuilding Tool

Bankruptcy is often seen as a symbol of failure, but in reality, it is a structured tool for businesses to reorganize. Kodak used Chapter 11 to shed unprofitable divisions, restructure debt, renegotiate contracts, and stabilize operations. This period enabled the company to focus on areas where it still had strength: commercial printing, chemicals, and intellectual property licensing.

For many companies, bankruptcy can create the breathing room needed to focus on the future rather than drown under old obligations. It forces leaders to evaluate what is essential, what must change, and what must be discontinued altogether. Kodak emerged from bankruptcy slimmer, strategically refocused, and ready to rebuild.

The Surprising Return of Kodak Film

The biggest surprise in Kodak's comeback story is the resurgence of film photography. What was once considered outdated became embraced by a new generation seeking authenticity, creativity, and physical media. Kodak responded not by abandoning its roots but by reintroducing beloved film stocks, expanding production capacity, and partnering with retailers and creators worldwide.

The success of their revived film lines illustrates that markets are cyclical and consumer preferences evolve. A product can fall out of favor, return unexpectedly, and even outperform projections when nostalgia, artistry, and culture intersect. Kodak's willingness to rediscover its core identity became a competitive advantage rather than a weakness.

Lessons for B2B Companies and Creditors

Kodak's revival is more than a feel-good story; it offers meaningful lessons for B2B businesses facing financial distress or slow cash flow. First, bankruptcy does not equal failure; it is a mechanism designed to preserve value, protect jobs, and give companies a chance to reorient. Many businesses emerge stronger, more efficient, and more focused than before.

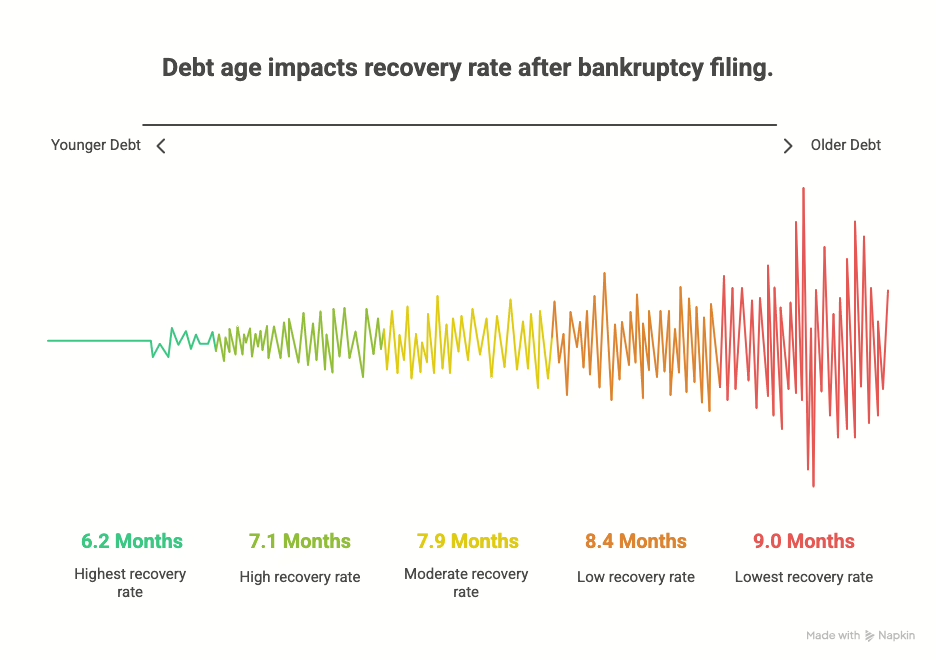

Creditors should also recognize that clients undergoing reorganization are not necessarily lost causes. When handled strategically, debt restructuring or professional recovery efforts can help stabilize a distressed company before accounts become uncollectible. Communication, documentation, and early action matter. Just as Kodak found room to reinvent itself, many companies can stabilize when given the proper structure and time.

For businesses managing accounts receivable, Kodak's journey underscores the importance of evaluating long-term viability rather than reacting solely to short-term challenges. A financially strained company today may become a strong customer tomorrow if recovery strategies are aligned with realistic timelines and professional guidance.

On a final note

Kodak's story demonstrates one powerful truth: bankruptcy is not the end of a business; it is often the beginning of a new chapter. Through restructuring, strategic focus, and a willingness to embrace both innovation and legacy, Kodak reclaimed its market position. For companies facing financial pressure, this serves as a reminder that challenges do not define the future. With the proper adjustments, businesses can recover, adapt, and even rediscover the value that made them successful in the first place.

As a finance manager, you understand the importance of a smooth and timely financial close. But even with the best strategies, challenges can arise. That’s where the right partnership can make all the difference. At Burt and Associates, we specialize in tailored, ethical debt collection practices that align with your business goals. By integrating our services, you can focus on optimizing your financial close process without the added stress of managing overdue accounts.

We know every business is unique, and that’s why we work closely with you to develop a customized approach that meets your specific needs. Whether you’re dealing with complex financial situations or simply looking to improve cash flow, our team is here to support you every step of the way.

Let’s turn those strategies into results together. Take the first step towards a more efficient financial close by reaching out to us today.

Let's Work Together to Optimize Your Business!

At Burt and Associates, we specialize in business-to-business (B2B) debt collection, prioritizing strong business relationships and tailored ethical recovery practices. Choose the approach that best fits your needs, and let’s take the first step toward improving your cash flow.

If you’re ready to discuss your overdue accounts and explore customized solutions, schedule a free consultation with one of our experts.

Schedule an Appointment.

Commercial Collection Topics

- Fair and Accurate Credit Transaction Act (FACTA) Defines what the Fair and Accurate Credit Transaction Act (FACTA) is and how it protects....

- Five C’s of Business Credit The five major components potential creditors review before extending credit....

- Why Choosing the Right Collection Agency is Important A collection agency can help you recoup any payments that were not paid to your company, but finding the right...

- Accounting Tactics to Increase Short-Term Earnings Describes what can be done with accounting tactics to boost short-term earnings. Uses Enron as an example of a worst...