Capital Spending

The frequency of reported capital outlays over the past six months rose two points to 47 percent of all firms, three points above the 35 year record low. Of those making expenditures, 32 percent reported spending on new equipment (up two points), 16 percent acquired vehicles (up one point),and 12 percent improved or expanded facilities (up two points). Three percent acquired new buildings or land for expansion (down one point) and nine percent spent money for new fixtures and furniture (down one point). Not great, but showing some strengthening tendencies. The percent of owners planning capital outlays in the future fell one point to 18 percent because the environment for capital spending is not good.

Debt Financing

Perhaps you’re not especially enamored of your banker right now. About 70 percent of banks recently tightened their standards on loans to companies with less than $50 million in annual sales, according to a survey by the Federal Reserve, and more than 40 percent of the banks reported reducing credit lines for their small-business customers making Bankers out of small business and having to collect commercial accounts. Unfortunately, no business can afford a rift with its banker — especially in tough times like these. In fact, this is precisely the time to give your lender some special attention. “If you work on building a relationship, then, in the event that there is a bump in the road, you can approach it from a position of familiarity and understanding.

Tips to focus on commercial accounts

- Focus on accomplishing the vital few rather than the important many

- limit interruptions

- Make your requests specific

- Set due dates

- Delegate don’t abdicate

- Insist on less talk and more action

- Hire smart or work hard

- Ask for help

- Adopt a low tolerance for missed commitments

- Never give up!

Commercial Collection Topics

- Top 3 things to consider when placing accounts for commercial collections Top 3 things to consider commercial debt collection; Getting Paid!, Protecting Your Company’s “BRAND” and Licensing, Bonding, and Insurance...

- Turning Accounts Over to Collections The fact is that collecting the debts you are legally owed is actually an ethical responsibility of any business owner....

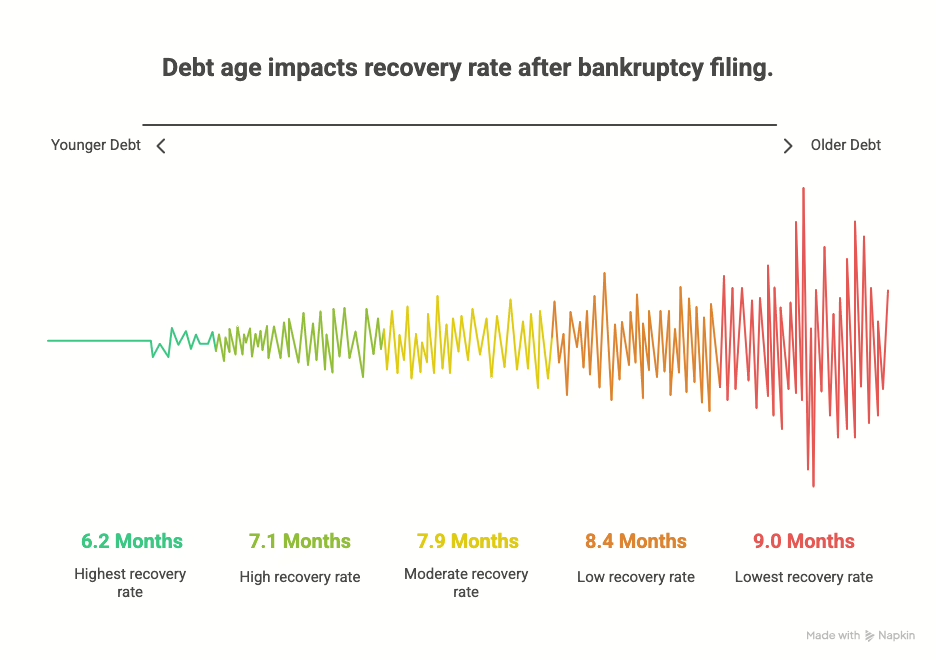

- A Guide Dealing with Delinquent Accounts When receivables age without a consistent and disciplined approach to collection, they begin to lose value. The longer a debt...

- Accounts Receivables Aging Schedule The Accounts Receivable Aging Schedule is a useful tool for analyzing the aging of your accounts receivable. Analyzing the schedule...