Table of Contents

1. Bankruptcy and Debt Collection Overview

When a business files for bankruptcy, it becomes increasingly complex for creditors to recover unpaid invoices. A bankruptcy petition halts most collection activity due to the automatic stay provision under U.S. law. While this protects the debtor, it can leave many small and mid-sized creditors at risk of permanently losing revenue.

According to the U.S. Courts Bankruptcy Statistics, commercial bankruptcies have increased in recent years. This is a trend every credit manager should be aware of when extending terms.

2. Impact on Creditors

Creditors are typically categorized into secured, priority, and unsecured creditors in a bankruptcy case. If you’re in the latter group, the odds of recovering anything from a bankrupt client drop dramatically. Many small businesses that rely on cash flow can suffer devastating losses from just a single unpaid invoice.

That’s why companies need to use proper credit applications, conduct thorough background checks, and closely monitor payment patterns before defaults occur. Creditors should also partner with experienced business-to-business collection agencies that understand how to pursue debts before and during bankruptcy proceedings.

3. Current Bankruptcy Statistics

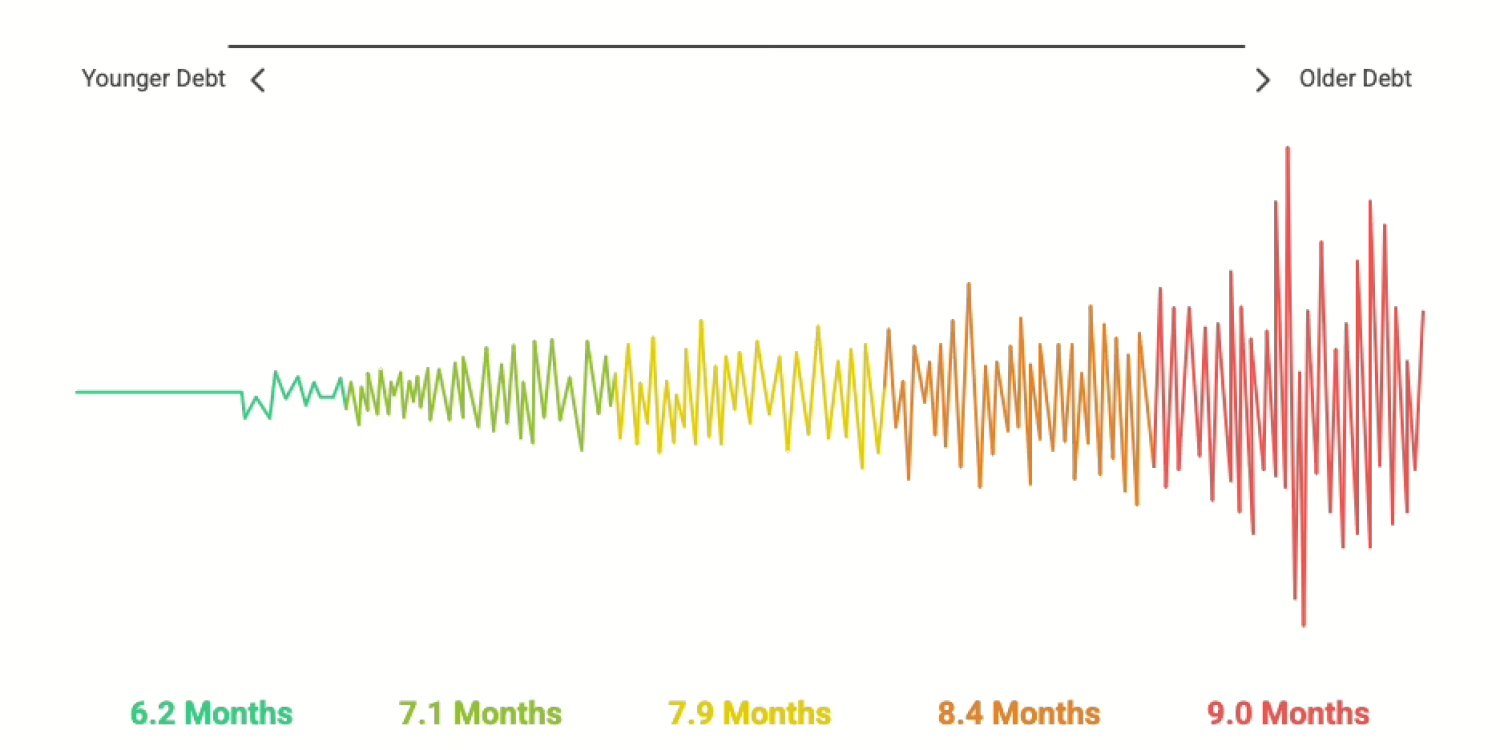

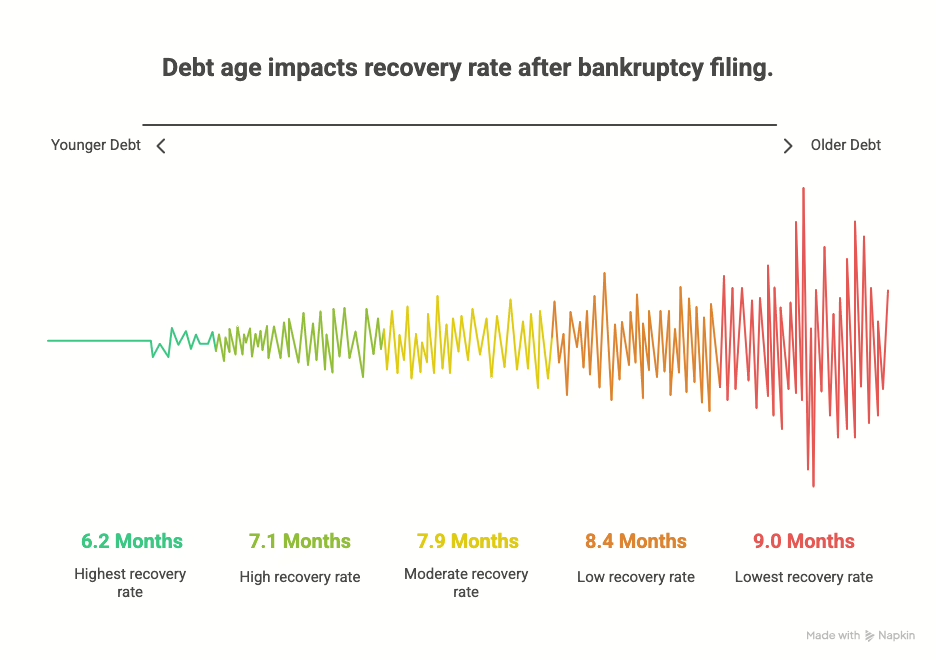

Below is a table based on real data pulled from recent commercial bankruptcy filings and collection performance. Use it to visualize trends and risk levels:

| Quarter | Business Bankruptcies | Recovery Rate (%) | Avg Age of Debt (Months) |

|---|---|---|---|

| Q1 2024 | 5,740 | 48.6% | 6.2 |

| Q2 2024 | 6,530 | 44.3% | 7.1 |

| Q3 2024 | 6,840 | 42.1% | 7.9 |

| Q4 2024 | 7,310 | 39.8% | 8.4 |

| Q1 2025 | 7,460 | 36.9% | 9.0 |

As visible in the data, the **longer a debt remains unpaid**, the lower the chance of recovery, especially if bankruptcy is filed.

4. What Collectors Can Do During Bankruptcy

Once a debtor files for bankruptcy, you must immediately cease traditional collection actions. Instead:

- File a proof of claim with the bankruptcy court

- Attend creditors’ meetings when applicable

- Engage legal counsel or an experienced collection partner to represent your interests

In some Chapter 11 cases, there’s potential for partial repayment or post-confirmation agreements. But don’t wait for miracles. Creditors who act fast and follow procedure can sometimes recover 10–50% of what they’re owed.

5. Preventive Measures Before Default

The most effective way to protect yourself from bankruptcy losses is to avoid risky clients in the first place. Best practices include:

- Requiring a signed credit application before extending terms

- Setting limits on credit exposure

- Using personal guarantees when possible

- Monitoring accounts for signs of cash flow trouble

And most importantly, don’t delay in seeking help. Agencies like Burt and Associates specialize in business collections and can act before bankruptcy makes recovery nearly impossible.

As a finance manager, you understand the importance of a smooth and timely financial close. But even with the best strategies, challenges can arise. That’s where the right partnership can make all the difference. At Burt and Associates, we specialize in tailored, ethical debt collection practices that align with your business goals. By integrating our services, you can focus on optimizing your financial close process without the added stress of managing overdue accounts.

We know every business is unique, and that’s why we work closely with you to develop a customized approach that meets your specific needs. Whether you’re dealing with complex financial situations or simply looking to improve cash flow, our team is here to support you every step of the way.

Let’s turn those strategies into results together. Take the first step towards a more efficient financial close by reaching out to us today.

Let's Work Together to Optimize Your Business!

At Burt and Associates, we specialize in business-to-business (B2B) debt collection, prioritizing strong business relationships and tailored ethical recovery practices. Choose the approach that best fits your needs, and let’s take the first step toward improving your cash flow.

If you’re ready to discuss your overdue accounts and explore customized solutions, schedule a free consultation with one of our experts.

Schedule an Appointment.

Commercial Collection Topics

- The Power of Promptness In the world of commercial debt collection, time is undeniably of the essence. Picture this: a business extends credit to...

- Debtor in Possession: What it Is and How it’s Used A Debtor in Possession must keep meticulous financial records. If the court or creditors find that court orders aren’t being...

- Commercial Collection: Stress Fortunately, today nearly 50% of America’s large companies provide their employees with stress management training, but there is still a...

- The Impact of Credit Cards on the American Economy The debt collection industry is essential to the credit market. By making sure borrowers make good on their delinquent debt....