Effective accounts receivable (AR) management is essential for maintaining healthy cash flow and ensuring a business’s financial stability. While setting credit limits is fundamental, businesses often turn to a commercial collection agency to recover overdue payments and streamline collection efforts. Adopting a comprehensive strategy beyond credit limits—such as proactive invoicing, clear payment terms, and strategic collections—can significantly enhance AR processes. This article explores key components contributing to robust AR management and how partnering with a commercial collection agency can improve financial outcomes.

1. Establish Clear Credit Policies

Developing well-defined credit policies sets the foundation for consistent and fair credit practices. These policies should outline the criteria for extending credit, payment terms, and procedures for handling delinquent accounts. By standardizing these processes, businesses can mitigate risks associated with arbitrary credit decisions.

Take inspiration from real-world examples: A manufacturing company streamlined its credit policies and saw a 15% reduction in overdue accounts within six months. Establishing clear guidelines not only minimizes risk but also ensures smoother operations.

2. Implement a Rigorous Credit Evaluation Process

Before extending credit, conduct thorough assessments of potential customers’ creditworthiness. This evaluation should include analyzing financial statements, credit reports, and payment histories. Utilizing credit scoring models provides objective insights into a customer’s ability to fulfill payment obligations.

Additionally, make it a point to leverage technology where possible. Automated credit assessment tools can simplify this process, helping your team make more informed decisions.

3. Monitor Accounts Receivable Aging Reports

Regularly reviewing AR aging reports helps identify overdue accounts and assess the effectiveness of your collection efforts. Categorizing receivables based on the length of time they have been outstanding enables businesses to prioritize collection activities and implement targeted recovery strategies. Check our case studies to view some of the business debt collection processes.

4. Automate Invoicing and Payment Reminders

Leveraging technology to automate invoicing and payment reminders streamlines the AR process. Automated systems reduce human error, ensure timely customer communication, and expedite the collection cycle. Implementing electronic invoicing and setting up automated reminders can significantly improve payment timeliness.

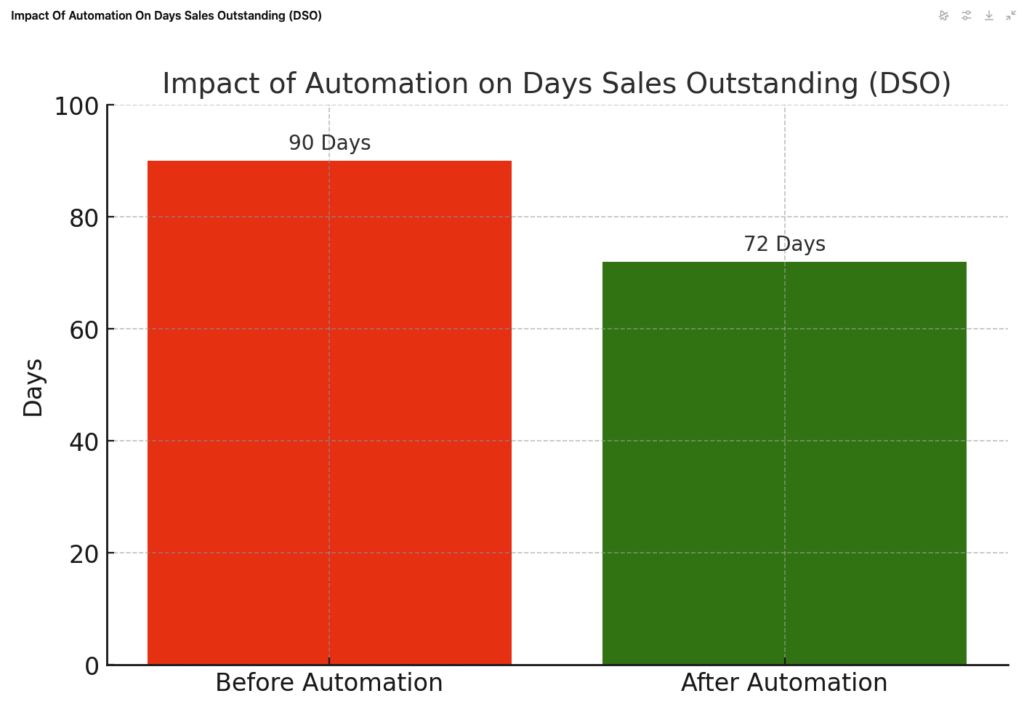

Impact of Automation on DSO (Days Sales Outstanding)

One key area where automation significantly enhances accounts receivable management is in reducing Days Sales Outstanding (DSO)—a critical metric for measuring how quickly a business collects payments. For instance, a service provider struggling with prolonged payment cycles integrated an automated invoicing system, leading to a 20% reduction in their DSO within six months. This improvement expedited their cash flow, reduced the labor involved in manual follow-ups, and minimized invoicing errors.

Automated tools streamline the invoicing process, ensuring timely invoice delivery and setting up automatic reminders for upcoming or overdue payments. Businesses can easily track and address late payments without compromising customer relationships.

The following graph illustrates the impact of automation on DSO reduction, comparing the time before and after the adoption of automated invoicing:

5. Offer Flexible Payment Options

Providing customers with multiple payment methods, such as credit cards, electronic funds transfers, and online payment portals, enhances convenience and encourages prompt payments. Flexibility in payment options can also improve customer satisfaction and strengthen business relationships.

If your customers have diverse payment preferences, offering these options can serve as a powerful differentiator in customer retention and satisfaction.

6. Maintain Open Communication Channels

Establishing and maintaining open lines of communication with customers is vital for effective AR management. Proactively addressing payment issues, negotiating payment plans, and understanding customers’ financial situations can lead to more successful collections and preserve valuable business relationships.

Empathy and understanding go a long way. For instance, tailoring payment plans for customers going through short-term financial difficulties can help ensure repayment while preserving long-term relationships.

7. Regularly Review and Adjust Credit Terms

As market conditions and customer circumstances evolve, it’s essential to reassess and adjust credit terms periodically. Regular reviews ensure credit policies align with the company’s risk tolerance and financial objectives. Adaptability in your credit approach can help mitigate potential losses and capitalize on new opportunities.

8. Train and Develop AR Personnel

Investing in the training and development of staff responsible for AR management ensures they are equipped with the necessary skills and knowledge. Well-trained personnel can effectively handle collections, negotiate with customers, and utilize AR management software, improving efficiency and reducing delinquency rates.

Provide ongoing learning opportunities such as workshops or certifications. An educated team is a cornerstone of successful AR management.

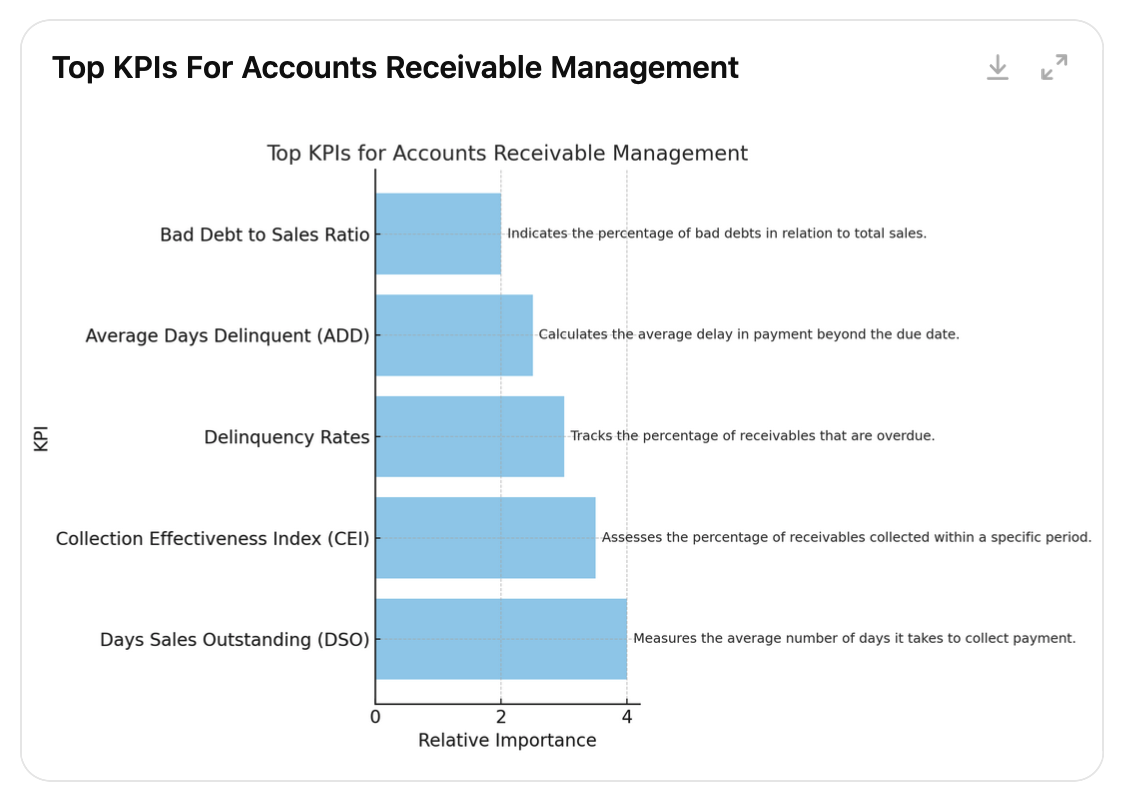

9. Utilize Key Performance Indicators (KPIs)

Tracking KPIs such as Days Sales Outstanding (DSO), collection effectiveness index, and delinquency rates provides valuable insights into the performance of your AR processes. Regular monitoring of these metrics enables businesses to identify improvement areas and implement corrective actions promptly.

10. Develop a Contingency Plan for Bad Debts

Despite best efforts, some accounts may become uncollectible. Establishing a contingency plan for bad debts, including setting aside provisions and having procedures for writing off uncollectible accounts, helps manage financial statements and maintain stakeholder transparency.

To add context, share a scenario where bad debt provisioning prevented severe financial impact, highlighting the importance of preparation.

Managing accounts receivable effectively is about more than just setting credit limits—it’s about adopting a proactive, strategic approach that safeguards your cash flow and strengthens your business relationships. By implementing a comprehensive accounts receivable management strategy, you can reduce risks, improve collection rates, and ensure your business stays financially healthy.

At Burt and Associates, we specialize in helping businesses like yours navigate the complexities of receivables management. Whether it’s recovering overdue accounts, analyzing debtor trends, or streamlining your processes, our tailored solutions are designed to deliver results.

Ready to take your accounts receivable management to the next level? Explore our case studies to see how we’ve helped businesses like yours succeed, or schedule a consultation to discuss your unique challenges and goals. Let’s work together to optimize your cash flow and drive your business forward!

Let's Work Together to Optimize Your Business!

At Burt and Associates, we specialize in business-to-business (B2B) debt collection, prioritizing strong business relationships and tailored ethical recovery practices. Choose the approach that best fits your needs, and let’s take the first step toward improving your cash flow.

If you’re ready to discuss your overdue accounts and explore customized solutions, schedule a free consultation with one of our experts.

Schedule an Appointment.

Commercial Collection Topics

- Days Receivable Outstanding DSO Calculation The DSO (Days Sales Outstanding) can be used to determine if a business wants to hide weak sales or is...

- Accounting Rule #48 Describes what Accounting Rule 48 is and how to comply....

- Export Credit Insurance Defines what export credit insurance is and the benefits to the policy holder....

- The Silent Menace within Accounts Receivables Describes how accounts receivable depreciate in value due to aging of the account and diminishing probability of collecting....