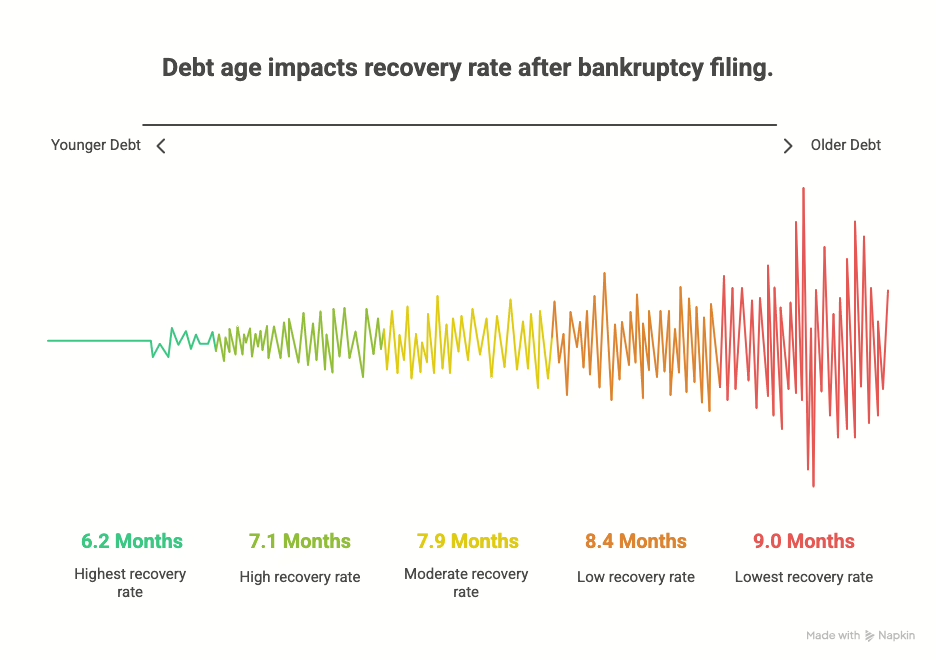

The activities of third-party debt collectors affect millions of borrowers. However, relatively little is known about their impact on consumer credit. To study this issue, I investigate whether state debt collection laws affect the ability of third-party debt collectors to recover delinquent debts and if this, in turn, affects the amount of credit being provided. This paper constructs, from state statutes and session laws, a state-level index of debt collection restrictions and uses changes in this index over time to estimate the impact of debt collection laws on revolving credit. Stricter debt collection regulations

appear to reduce the number of third-party debt collectors and to lower recovery rates on delinquent credit card loans. This, in turn, leads to fewer openings of credit cards. (excerpt from doc)

Debt Collection Agencies and the Supply of Consumer Credit

Original Source

The Philadelphia Fed’s Research Department occasionally publishes Working Papers. These papers, dealing with virtually all areas within economics and finance, are intended for the professional researcher

Commercial Collection Topics

- Top 3 things to consider when placing accounts for commercial collections Top 3 things to consider commercial debt collection; Getting Paid!, Protecting Your Company’s “BRAND” and Licensing, Bonding, and Insurance...

- What The Recent Rise in Bankruptcies Means For You Just because bankruptcies are on the rise doesn’t mean you have to let your debts go unsettled. This article to...

- Be Aware of New Red Flag Law FTC Chairman Jon Leibowitz advised in a December 8, 2010, press release that Congress has announced that all organizations who...

- Debtor in Possession: What it Is and How it’s Used A Debtor in Possession must keep meticulous financial records. If the court or creditors find that court orders aren’t being...