Accounts Receivables or A/R = someone owes you money

Example: If you have a $500 sale purchased on credit, your A/R = $500. If they don’t pay, you must write off the debt to the provision for loan losses account.

A/R Net = Accounts Receivables – Provision for loan losses

Another concept to know is Receivables Turnover. Receivables Turnover = how often (or how fast) the customer is paying during this period (typically a year).

Receivables Turnover = (Total of all credit sales) / (A/R).

Example: $10,000 / $1,000 = 10 times

So, if your annual sales = $10,000 and A/R turnover = 10 times during the year = Your average A/R balance = $1000

Commercial Collection Topics

- What is Inventory Turnover? Defines Inventor turnover and how to compute it. Also, how to compute Average Inventory and Average Days to Sell....

- Options and Accounts Receivable What an option is and how to settle (close) the transaction. Comment about using accounts receivables to buy an option....

- Accounts Receivables Inflated by Customer Deductions How unmanaged customer deductions can inflate accounts receivable....

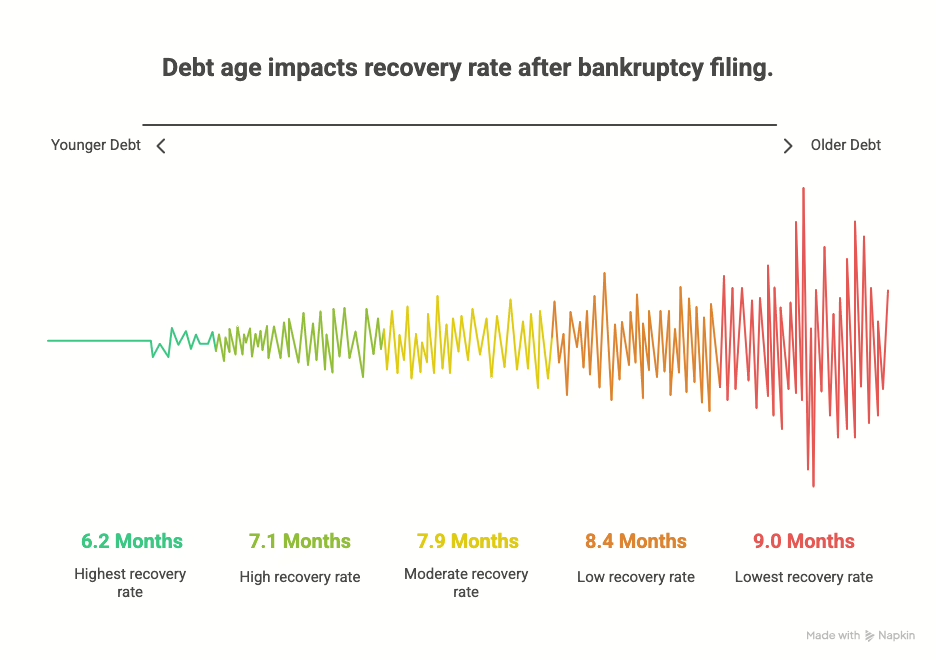

- Accounts Receivables Aging Schedule The Accounts Receivable Aging Schedule is a useful tool for analyzing the aging of your accounts receivable. Analyzing the schedule...

Related Terms: