My Customer Hasn’t Paid Me- What Now?

There are few things more aggravating than lending money to someone who now refuses to pay you back. If you’ve been placed in this uncomfortable position before you are all too familiar with the financial setback it creates, the effect of pinched cash flows, the emotional trauma and the fallout of having to be “the bad guy” collecting a debt; it’s all too infuriating at times.

Fortunately, collecting payment is not always a dire situation nor is it always the result of malicious intent by your customer. Sometimes not receiving payment is a matter of misunderstanding. Billing letters become lost in the mail, an emailed invoice went into the client’s spam box, someone went on vacation and forgot to setup payments, etc.. The point is, life happens, it doesn’t excuse the lack of payment but can explain how it was forgotten. Working with your customer in a friendly manner in these cases is important if you want them to continue doing business with you. Often in these situations, you will find the customer able to make payment and willing to expedite a check to you. It’s just a matter of communication.

In situations that are more problematic, you may have a customer who is willing to pay but just unable to in the present. Their business may be suffering a liquidity and working capital crisis for reasons unknown to you. It may be a short-term issue, or it could be a long-term problem, either way, you and your customer are in a jam because they don’t have cash to pay you promptly. It can be a tough situation, but if you can negotiate extended terms with your customer, you may find that the goodwill created by such a gesture makes them a loyal customer for life.

Bringing a ten-pound hammer to fix a watch is a sure way to make a permanent mess and have nothing at the end for your efforts. The point is, often there are appropriate ways to work around each situation that will result in you receiving payment and simultaneously building a stronger relationship with your customer.

And you still have options even when a problematic customer refuses to honor their commitment to pay out of spite.

Four important things that can significantly increase your chances of getting every penny owed to you.

- In small business to business transactions, the person you lent money to will try to turn the situation into a “personal issue” and blame you for being “part of their problems.”

They may have just lost their biggest customer, or had a job go bad, or recently named in a lawsuit and the situation has now resulted in unforeseeable financial woes for them. It happens, don’t take it personally. Remember, it’s just business.

You don’t want the customer to see you as ‘the enemy,’ rather you want to help them see your side of the equation and show that this is a business matter and the unpaid debt is part of an agreement they made with you. Either they need to pay the debt, negotiate terms, or expect that you are willing to make every effort to recover your money – even if that includes reporting the bad debt to credit agencies, placing the debt into collections, or taking legal action. - “He who documents the most, wins.” It’s very simple, keep accurate documentation and maintain evidence that the customer’s debts are owed to you. If you have formal written agreements, file the originals in a safe place and make copies as necessary. If you have executed invoices and billing records, keep it in the file where you can find it. If you have an enforceable contract, make sure you have followed it and remedy anything that hasn’t been followed to the letter. And always keep copies of all emails, letters, notes from phone calls and discussions. All of this documentation demonstrates what the terms agreed upon are and as a course of habit, you should be documenting all of your customer (and supplier) transactions in writing or electronic form. They owe you money? Prove it.

- Make payment demands in writing. Your documentation process should include demand letters, people can argue what was said in a phone call, but they can’t debate what was stated in a well-written demand letter.

You are writing a business letter so be professional and to the point. Always reiterate the terms of the original agreement and exchange, demonstrate how much is owed and when it was owed, and in closing communicate clearly what is expected of the customer to remedy the situation. Make sure you are honoring your contracts and be sure to stick to the facts in your demand letter. Also, it’s always a good idea to mail demand letters by certified mail. That way you have evidence that you sent them your letter and it was delivered. - If you haven’t been able to collect all of your money and your customer refuses to negotiate with you or return your calls, then it’s time to escalate the situation.

Getting in touch with a business debt solutions provider like Burt and Associates may be the best option for getting paid. And this may mean intensifying collection efforts by turning the debt over to our collection agents, engaging our attorneys or sending a failure to pay notices to be recorded with credit bureaus. Sometimes the mere threat of these actions is enough to motivate a debtor to pay.

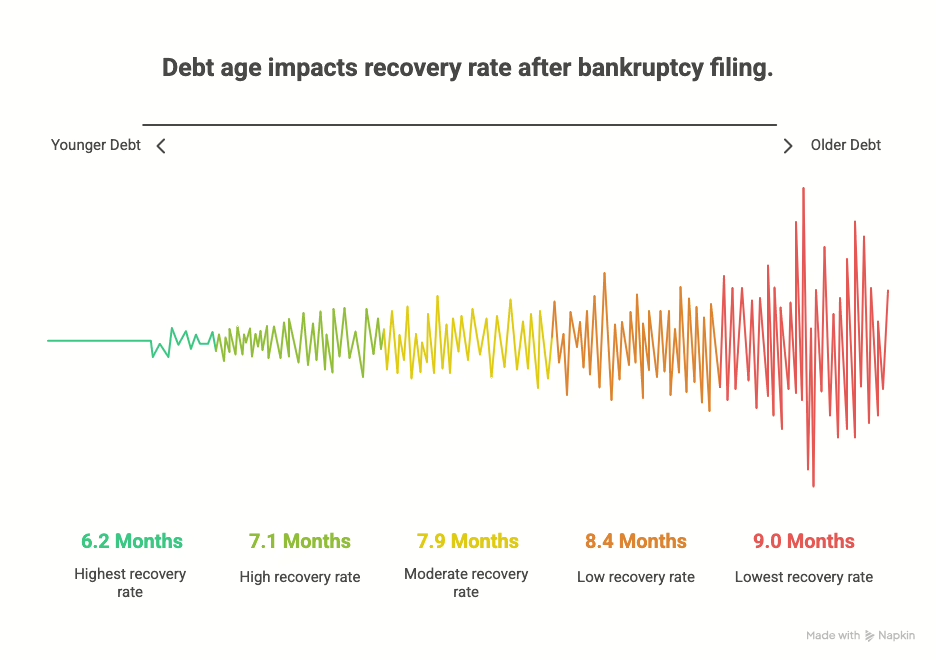

But after all of these efforts, the best solution may be to take the debtor to claims court or enter into mediation or arbitration. In some cases when the debtor is filing for bankruptcy, you will want to be sure that the debts owed to you are included in the bankruptcy court documents.

We may not be able to save you the heartache of dealing with a bad customer, but we can certainly help you collect on bad debts. No matter the situation, Burt and Associates can help you identify the best solutions for collecting debts owed to you.

When you have debt collection issues and need someone on your side, or maybe you want a better understanding of how you can recover bad debts, you can count on Burt and Associates to help. Contact us today through our website, email, or by phone. Our representatives are available to help you today.

Commercial Collection Topics

- Buying Assets From a Distressed Company Describes many potential problems when buying assets of a distress company, whether in or outside of bankruptcy. ...

- Watch for Verbiage Consistency when Exporting When exporting, advises to ensure all verbiage is consistent to ensure payment. ...

- What is next after account goes past due? So what does it mean when your debt goes into the hands of a collection agency. When the past due...

- Keep Contact Information Good Communications lead to Good Collections. Emails are all important avenues for communication, not just for marketing but debt collection...